Join AUIC And

Get Great Benefits

Get the Tools and Resources you need to be successful as a Self-Employed, independent creator with an AUIC Membership. Enjoy business resources, health-related savings, telehealth services, exclusive access to benefits, and more.

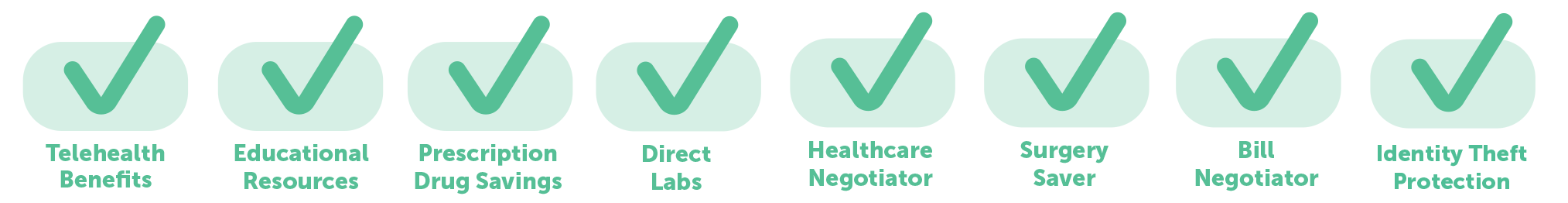

Discover an impressive suite of services and savings with AUIC’s Elite Care Membership, networking opportunities, educational resources, featuring telehealth services, prescription drug discounts, exclusive access to insurance products, Direct Labs, Epic Hearing, Healthcare Navigator, Surgery Saver, and Bill Negotiator.

Services Included:

Teladoc Health

- Access to qualified, board-certified clinicians anytime, anywhere. Our

clinicians diagnose, treat and even prescribe medicine if needed. - Support for a wide range of everyday conditions, from cold and flu to a

rash or sunburn. - Don’t wait months for access to a dermatologist. Take pictures of your

skin condition and upload to the app for a dermatologist’s review. - Within 24 hours, you’ll have a diagnosis and treatment plan customized

to fit your specific needs. * - Mental Health appointments: Have real conversations and see progress

with a therapist or psyciatrist of your choice. Available 7 days a week

from the privacy of your own home.*

*additional fee required

SECURUS ID Identity Theft Protection

Supports members in restoring their identity in the event their identity is compromised.

- Full triage on first call with live access to all three credit bureau files.

- Offers bilingual specialists, multilingual and hearing-impaired services are offered 24-hours a day, 7-days a week.

- Includes Limited Power of Attorney so that the specialist assigned to members case can truly complete all restoration activities on members behalf.

- Delivers value when members need it most and protects individuals in the event of identity theft.

- Lost Wallet Service

DirectLabs

AUIC Members have access to discounts on lab work, which includes a private and secure online account called “MyDLS” where you will access your orders, print your lab requisition, and retrieve your results. DirectLabs offers a wide variety of important health and wellness blood chemistry tests directly to you online. Confidential results are available online in as little as 24 hours for most tests.

Drug Card America

With an AUIC membership, you will receive a prescription savings card designed to help lower the cost of brand-name and generic prescription drugs. Able to be used at over 62,000 participating pharmacies nationwide, this program provides an average savings of 38% (program savings data).

Healthcare Navigator®

Advisors empower members with healthcare knowledge and confidence while saving them time and money. Advisors assist you with physician, prescription cost and healthcare facility searches, as well as health cost estimates, alternative medicine options and Affordable Care Act (ACA) answers, and more.

Surgery Saver®

Surgery costs can vary greatly from facility to facility, and from experience, we have seen a 66% cost difference for the same surgical procedure with no appreciable difference in quality. An expert Advisor shops up to five surgical facilities to verify the best available price, quality and availability for non-emergency procedures, as well as physician privilege verification.

Bill Negotiator®

Since 2008, we have earned an average of 80% savings on the members’ out-of-pocket portion of medical bills through our negotiations. A dedicated Patient Advocate works directly with a member’s healthcare providers to help reduce their out-of-pocket portion of their medical bills.

Services above provided by Karis360, Healthcare Navigator, Surgery Saver, and Bill Negotiator are registered trademarks of The Karis Group. Karis360

is not insurance and does not provide funds to pay for bills. This is a best-efforts service and results can not be guaranteed.

Insurance Benefits Included:

Accident Medical Expense Benefit

The Accident Medical Expense Benefit (AME) pays in excess of any other insurance coverage you may have for the expenses you are charged by a hospital, doctor, or certain other charges, up to a maximum of $5,000 if you are injured in a covered accident. Subject to a $100 deductible.

Accidental Death & Dismemberment Benefit

The Accidental Death & Dismemberment Benefit (AD&D) pays the beneficiary up to $25,000 for the member’s death or loss of certain body parts (e.g. limbs, speech, eyesight, or hearing) in a covered accident.

If, within 365 days from the date of an Accident which occurs while coverage is in force, Injury from such Accident results in a loss covered by this benefit, We will pay the benefit in the amount set opposite such loss, as shown on the Schedule of Benefits. If more than one such loss is sustained as the result of one Accident, We will pay only one amount, the largest to which the Covered Person is entitled.

Hospital Indemnity Benefit

Hospital indemnity benefit provides support by offering a fixed daily amount of $250, for up to 30 days, to help offset the costs associated with a hospital stay. This benefit ensures that individuals have an additional layer of financial security during their hospitalization.

Critical Illness Benefit

(Cancer Lump Sum Benefit Rider and Limited Specified Disease Benefit Rider)

The Cancer Lump Sum Benefit RIder and Limited Specified Disease Benefit Rider (CHS) pay the insured up to $5,000 in the event they are diagnosed with a critical illness such as cancer, heart attack, or stroke.

Cancer Definition: Cancer means a disease manifested by the presence of a malignancy characterized by the uncontrolled growth and abnormal spread of malignant cells and the invasion of body tissue by such malignant cells. Cancer includes Hodgkin’s disease and leukemia. This definition excludes such cancers as:

Pre-malignant tumors or polyps; Skin Cancer, except malignant melanoma; and Cancer In Situ.

Cancer will not be a covered condition when advice or treatment is received within the Waiting Period, if any, or prior to the Effective Date, and such advice or treatment leads to the Diagnosis of Cancer. If tissue is extracted during the Waiting Period, if any, or prior to the Effective Date, and results in a Diagnosis of Cancer, this will not be a covered condition. If Cancer is Diagnosed and/or treated within the Waiting Period, or if medical advice is given within the Waiting Period which leads to the subsequent Diagnosis of Cancer after the Waiting Period, the Covered Person has the option to cancel the Rider and receive a refund of all premiums paid on this Rider. For the purposes of this Rider, the date of Diagnosis will be considered to be the earlier of the date of clinical Diagnosis or the date the specimen used to diagnose Cancer is taken.

Exclusive Access to Group Rates on Insurance Products:

FlexTerm Health Insurance helps to protect you from the

medical bills that can result from unexpected Injuries and

Sickness.

Safeguard your financial future with FlexTerm Health

Insurance. It provides the peace of mind and health care

access you need at a price you can afford.

Ready to Get Started?

You are in the right place. Learn more about membership levels or sign up now today.

Accident Medical Expense, Accidental Death and Dismemberment, Hospital Indemnity, and Critical Illness Benefits, are

offered under Group Accident Only insurance issued on Policy form series MP-1300, Certificate form series GC-1300,

by Guarantee Trust Life Insurance Company (GTL), Glenview, IL. The policy is issued to Association of United Internet

Consultants (AUIC) and has exclusions, limitations, reductions of benefits, and terms of renewal and termination. Subject

to state availability, variability, and GTL’s right to increase rates. For complete details of coverage, please contact

us.

Cancellation/Termination of Benefits/Renewability

Coverage terminates when AUIC terminates the policy, your membership ceases, insurance ceases for your class,

for non-payment of premium by AUIC, or the date of fraud or misrepresentation of a material fact. The group policy

terminates for non-payment of premium, if group participation requirements are not met or on any premium due date

for any of the following reasons: fraud or misrepresentation of a material fact; failure of AUIC to provide required information;

or at GTL’s option with 30 days notice. Notice of termination provided to AUIC is considered notice of termination

to all members and will not be sent to you individually by GTL. The policy automatically renews each policy

anniversary until cancellation/termination. GTL does not provide nor is affiliated with the discount programs provided

as a part of membership in AUIC.

Rate Disclosure

The following monthly rates apply for coverage underwritten by GTL as part of your membership: $5,000 (AME) Benefit

Individual = $19.37, Individual Plus Spouse = $38.74, Individual Plus Children = $26.27, Family = $50.68.

Group Accident Insurance Exclusions:

The Policy does not provide benefits for:

- Treatment, services or supplies

-

-

- Are not Medically Necessary;

- Are not prescribed by a Doctor as necessary to treat an Injury;

- Are determined to be Experimental/Investigational in nature;

- Are received without charge or legal obligation to pay;

- Are received from persons employed or retained by any Family Member, unless otherwise specified; or

- Are not specifically listed as Covered Charges in the Policy.

-

-

- Injury by acts of war, whether declared or not.

- Injury received while traveling or flying by air, except as a fare-paying passenger and not as a pilot orcrew member, on a regularly scheduled commercial airline.

- Injury covered by Worker’s Compensation, Employer Liability law or Occupational Disease Act or Law.

- Dental treatment, except as specifically stated.

- Injury sustained while committing or attempting to commit a felony.

- Prescription Drugs except as specifically stated.

- Suicide or attempted suicide while sane or insane.

- Intentionally self-inflicted Injury.

- Loss resulting from being legally intoxicated or under the influenceof alcohol as defined by the laws of the state or jurisdiction in which the Injury occurs.

- Loss resulting from being under the influence of any drugs or narcotic unless administered on the advice of a Doctor.

Injury sustained while participating in or practicing for any professional, intercollegiate or club sports activity, except as specifically provided. - Injury which occurs while a Covered Person is on active duty service in any armed forces. Reserve or National Guard active duty for training is not excluded unless it extends beyond 31 days.

- Injury sustained flying in an ultra-light, hang gliding, parachuting or bungee-cord jumping, by flight in a space craft or any craft designed for navigation above or beyond the earth’s atmosphere.

- Injury sustained while driving or riding on vehicles for off-road use

- including but not limited to allterrain vehicles (ATV’s).

Injury sustained where a Covered Person is the operator and does not possess a current and valid motor vehicle operator’s license, except in a Driver’s Education Program. - Treatment in any Veteran’s Administration or federal Hospital, except if there is a legal obligation to pay.

- Cosmetic surgery, except for reconstructive surgery on an injured part of the body.

- Covered Charges incurred outside of the United States or its possessions.

- Competing in motor sports races or competitions;

- Competing in water sports races or competitions;

- Testing cars/trucks on any racetrack or speedway;

- Handling, storing or transporting explosives;

- Scaling up cliffs or mountain walls;

- Spelunking (exploring caves);

- Handling or working with dangerous animals.

- Injury sustained while water skiing or surfboarding;

- Injury sustained while snow skiing or snowboarding;

- Injury sustained while roller blading or skateboarding;

- Injury sustained while participating in a rodeo.

- Reinjury or complications of an Injury caused or contributed to by a condition that existed Before the Accident.

- Repetitive motion injuries, strains, hernia, tendonitis, bursitis and heat exhaustion not related to a specific Injury.

Pre-Existing Condition Limitation

A Pre-Existing Condition is not eligible for benefits unless the Diagnosis occurs after this Rider Effective Date and the Waiting Period, if any, has expired. We will not pay benefits for a Pre-Existing Condition that is Diagnosed within the Pre-Existing Period stated in the Schedule of Benefits.

A Pre-Existing Condition is not covered unless the loss begins after the Benefit Eligibility Period for Pre-Existing Conditions has elapsed as stated in the Schedule of Benefits.

Cancer Benefit Rider and Specified Disease Benefit Rider Exclusions:

We will not pay benefits for:

1. A Positive Diagnosis of Cancer before the Effective Date of the Covered Person’s coverage under the Policy;

2. Any loss due to injury, disease or incapacity, unless related to or attributable to Cancer as defined;

3. Any Cancer when advice or treatment is received during the Waiting Period or prior to the Effective Date, and such advice or treatment results in a Positive Diagnosis of Cancer. If tissue is extracted during the Waiting Period or prior to the Effective Date, and results in a Positive Diagnosis of Cancer, this will not be a covered condition. For the purposes of this Rider, the date of a Positive Diagnosis of Cancer will be considered to be the earlier of the date of clinical diagnosis or the date the specimen used to diagnose Cancer is taken. If a Positive Diagnosis of Cancer is made and/or Cancer is treated within the Waiting Period, OR if medical advice is given within the Waiting Period which leads to the subsequent Positive Diagnosis of Cancer

AAD27.6-23